ICRA Scorecard – Understanding Its Role and Importance Credit Rating Agencies play an important role when it comes to providing vital credit ratings that offer invaluable insights to investors and lenders. Amongst many services that ICRA Credit Rating Agency offers like ESG Ratings, Issuer Credit Ratings, and Portfolio Ratings, there stands a key tool – ICRA Scorecard. ICRA Scorecard is a Crucial tool that is used to evaluate the creditworthiness of various financial entities. ICRA Scorecard is designed in such a way that it provides us with transparent and objective information regarding credit risk which helps in facilitating well-defined decisions. ICRA Scorecard provides us with an in-depth understanding and assessment of financial health of an entity along with other parameters such as their position in the industry and their management quality. Why is the ICRA scorecard important? ICRA scorecard holds paramount importance and for many reasons. Here’s why.. Enhance Investor Confidence – It is a fact that many investors rely heavily on credit ratings when it comes to making investment. These credit ratings guide them by providing a transparent evaluation of creditworthiness and the potential risk involved. With these credit ratings it becomes easy for investors to navigate through the complexities of the financial realm and make informed decisions regarding their investment. Through ICRA Scorecard their confidence is boosted further facilitating more participation in the financial landscape. Promotion of Market Efficiency – ICRA Scorecard plays an important role when it comes to providing reliable and accurate credit assessments since financial markets depend heavily on availability of such information. ICRA Scorecard has an immense contribution when it comes to market efficiency and with this participants in the global market gets elite access to transparent and reliable credit ratings leading to a more stable financial market with better decision making. Effective Risk Management – Financial stability is crucial for investors with effective risk management. ICRA Scorecard helps mitigate risks by providing detailed information of credit risk involved further assisting investors in identifying, measuring and monitoring risks. This assessment ensures that engagement takes place with parties that are reliable further mitigating any risk of financial contagion. Access to Capital Markets – It becomes necessary for companies to gain funding to operate and for its growth. Investors favor entities that are rated highly which can further reduce the cost of capital for the issuer. This facilitates an entity’s ability to raise funds which can further be invested in expanding their projects and innovation. Leverage ICRA Scorecard for Financial Excellence Invest in the power of well-defined decision-making with ICRA Scorecard. At ICRA Credit Rating Agency we believe in providing credit evaluation that is comprehensive, transparent and accurate. With a motive to enhance investors’ confidence and fostering trust among counterparties, our key tool ICRA Scorecard holds a paramount importance in fostering this trust in the economic market and maintaining financial stability. ICRA Scorecard uses a robust methodology and with its continuous monitoring, it ensures that the information is provided with up-to-date information and accuracy. Reaching out to ICRA can be your next step toward financial growth and confidence. With ICRA you gain access to expert analysis, comprehensive rating services, and in-depth reports that can help you navigate the complexities of credit risk with great ease and confidence. For more info Visit here : www.icrallc.com

Category: Uncategorized

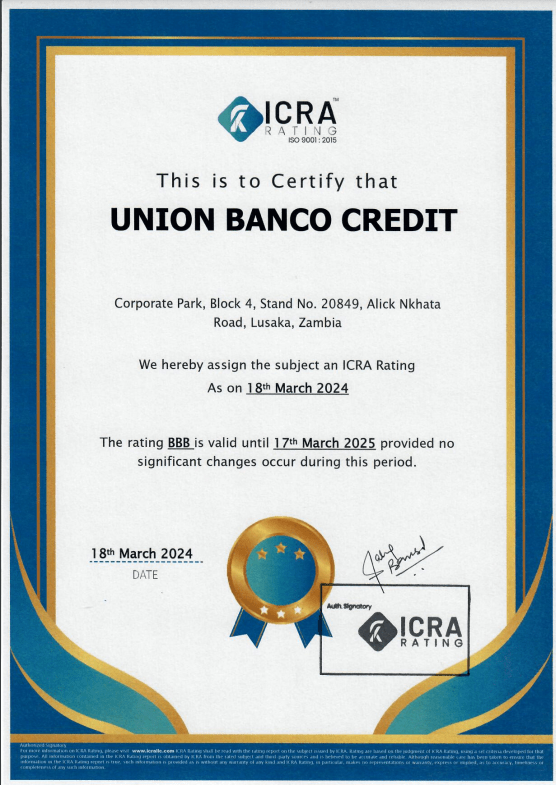

ICRA RATING assign Union Banco Credit Limited national scale long-term issuer

ICRA RATING assign Union Banco Credit Limited national scale long-term issuer rating to ‘BBB’ ICRA RATING assigns Union Banco Credit Limited national scale long-term issuer rating to BBB; Outlook Stable ICRA Ratings (ICRA) has assigned Union Banco Credit Limited national scale long-term issuer rating to BBB and affirmed the long-term stability of the institution in the domestic market. A rating means the entity has a considerable risk level to fulfill its financial commitments. There is a considerable risk of being adversely affected by foreseeable events and moderate credit risk on the institution

ICRA RATING assign Banco Micro Capital Finance Limited national scale long-term issuer rating

ICRA RATING assign Banco Micro Capital Finance Limited national scale long-term issuer rating to ‘A’ ICRA RATING assign Banco Micro Capital Finance Limited national scale long-term issuer rating to A; Outlook Stable ICRA Ratings (ICRA) has assigned Banco Micro Capital Finance Limited a national scale long-term issuer rating of A and affirmed the long-term stability of the institution in the domestic market. A rating means the entity is in a stable and strong position to fulfil its financial commitments. There is a marginal risk of being adversely affected by foreseeable events and low credit risk on the institution.

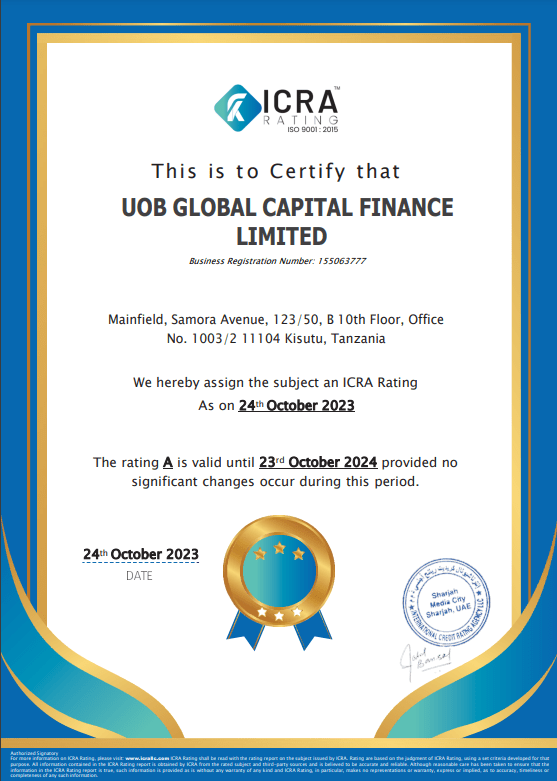

ICRA RATING assigns UOB Global Capital Finance Limited national scale long-term issuer rating to A

ICRA RATING assigns UOB Global Capital Finance Limited national scale long-term issuer rating to ‘A’ ICRA RATING assigns UOB Global Capital Finance Limited national scale long-term issuer rating to A; Outlook Stable ICRA Ratings (ICRA) has assigned UOB Global Capital Finance Limited a national scale long-term issuer rating of A and affirmed the long-term stability of the institution in the domestic market. A rating means the entity is in a stable and strong position to fulfill its financial commitments. There is a marginal risk of being adversely affected by foreseeable events and low credit risk on the institution.

ICRA Credit Ratings – Empowering Issuers with Financial Clarity

ICRA Credit Ratings – Empowering Issuers with Financial Clarity Credit ratings play a fundamental role in the functioning of capital markets along with shaping decisions regarding investments. The multifaceted role of credit ratings ranges from influencing borrowing costs to elevating economic growth and stability. This essential tool helps navigate investors, issuers, and financial institutions through the intricate dynamics of risk and opportunities in the financial sphere. At its core, credit ratings provide an evaluation of an entity’s ability to repay its financial commitment. These ratings are an indication of the likelihood of default further serving as a measure of credit risk. By providing transparent and accurate assessments, these ratings help investors make informed decisions regarding their investments. Complex financial data is translated into simplified ratings that allow the investors and financial institutions to make a comparison of the risk associated with different entities. ICRA Credit Rating Agency is one such agency that serves as a benchmark in providing reliable and accurate ratings. ICRA believes in fostering transparency with its credible insights to help maximize potential and influence investment decisions. Role Of Credit Ratings – The role of the credit ratings cannot be overstated especially when it is of profound significance for issuers. These ratings help corporations, financial institutions to influence their financial strategies, market position, investor confidence and regulatory compliance. Boosting Investor Confidence And Enhancing Market Credibility – Since these ratings are an evaluation of an issuer’s creditworthiness, the indication of these ratings help determine the overall financial health which helps investors in making well-defined decisions. A higher rating opens doors for multiple investment opportunities since a good rating is considered favorable by the investors as they rely heavily on it. The risk associated with investments is comforted by the issuer that is rated high as they are perceived as reliable and stable in financial terms. A favorable rating provides a justification for its ability to meet financial obligations by proving its credibility. Determination Of Cost Of Capital – The overall cost of debt is reduced if the issuer has a higher credit rating. Since the cost of capital is largely determined by the issuer’s credit ratings, a favorable rating has a higher chance of accessing the capital at a reasonable interest rate. Similarly, a lower credit rating can have a significant impact on their borrowing cost. These entities have a higher credit risk associated with them which makes it difficult for them to access the capital market and attract investment opportunities. Investors may generally limit their exposure to lower-rated entities and ultimately they have to face higher- interest rates. Market Perception And Investor Relations – A positive signal is indicated to the market when an entity has a higher credit rating. This helps in maintaining good relations with the investors and a good hold on the market perception of the entity. With a positive reputation, the chance for fostering trust and building confidence is elevated amongst the investors.by reinforcing a strong performance and market position, positive market perception is created for issuers with higher ratings. Meanwhile, a lower credit rating can downgrade its image in the market with a negative perception further leading to a decrease in potential investors and opportunities. Guiding Precision And Trust With ICRA – Credit ratings provided by ICRA play a crucial role in the financial sphere by providing accurate, in-depth, transparent ratings to help shape the financial strategies and decision making. ICRA serves as a barometer of creditworthiness by offering a comprehensive assessment of an entity’s credit risk further guiding investors, lenders, corporations to help influence their financial decisions. The use of methodology and in-depth analysis by ICRA are done to evaluate factors such as performance, operational efficiency, market condition, regulatory compliance. For more info Visit here : www.icrallc.com

ICRA Your Trusted Partner for Financial Clarity

ICRA Your Trusted Partner for Financial Clarity ICRA Credit Rating Agency is established with a commitment to provide in-depth insights offering clarity and reliability that are of paramount importance in the intricate world of finance. Uncertainty and risks lurk in every corner of the financial landscape and this is where reliable insightful information plays a vital role in shaping decisions. ICRA stands as a beacon of confidence and clarity when it comes to providing trusted and credible ratings helping shape investor confidence, foster economic growth, and facilitate strategic decisions. ICRA assesses the creditworthiness of various entities with its robust methodology and offers comprehensive insights on financial health and risk profiles to help drive better decision-making. With ICRA’s transparent ratings, it helps investors navigate the complex world of finance with utmost confidence. Comprehensive Services Tailored for Your Needs Like – Issuer Credit Rating – is an assessment of entities creditworthiness that provides a clear picture of their financial stability and risk associated with it. With ICRA’s analytical expertise and rigorous insights, it helps ensure that these insights are not just mere numbers but in-depth evaluations. Several factors are taken into consideration when evaluating such as the financial performance of the issuer, debt repayment history, and market position of the entity. Through these factors, a thorough assessment is done to recognize an issuer’s ability to meet financial obligations. These ratings are crucial as they play a vital role in shaping the perception of a certain entity in the market, further affecting the borrowing costs for issuers and attracting potential opportunities. Portfolio Rating – these ratings help provide an overall picture of the risk involved as it evaluates by focusing mainly on the actual portfolio of the financial institutions. With the information provided through thorough assessment it acts a helping hand in optimizing portfolio strategies and navigating the complexities in the financial market through utmost ease. Various risks associated with the financial institutions are identified such as credit risk, liquidity risk, market risk, and operational risk. This in-depth analysis ensures that institutions enhance their portfolio effectively by managing potential risks. Investors services – central to ICRA’s investors services, it offers credit ratings to help provide investors with reliable insights into the creditworthiness and risk profile of issuers as these ratings are crucial for evaluating assessment opportunities, risk associated which helps investors understand the dynamics of market and sector-specific risks and opportunities. ESG Ratings – Signifying its focus on three main criteria i.e. Environmental, Social, and Governance. These ratings drive investors towards sustainability and help them mitigate risks by fostering responsible investments through sustainable ethical practices. This shift from the traditional way of assessing to growing awareness of interconnectedness between corporate behavior and its impact on social and environment helps determine long term financial performance of a company. The impact of ESG ratings towards a positive change cannot be overstated in the evolving landscape of finance. ICRA – Premier Choice for Financial Excellence – Choosing ICRA means choosing a partner with trust, transparency and reliability in financial services. ICRA stands out as a top agency when it comes to providing in-depth, credible and accurate insights to help navigate complexities with clarity and confidence in the intricate world of finance by making well-informed decisions. With our cutting edge expertise and rigorous methodologies we ensure that your decisions are strategic, informed and forward looking in order to help you elevate your financial growth and journey with utmost clarity. For more info Visit here : www.icrallc.com

A comprehensive overview of ICRA Credit Rating services

A comprehensive overview of ICRA Credit Rating services ICRA credit ratings play a crucial role in helping the clients navigate through intricate dynamics of the financial world. It assists the clients in assessing the risk associated with investment opportunities in the financial market and helps them make well-defined decisions. These ratings are an indication of the issuer’s ability to meet financial obligations in a provided time frame. ICRA communicates the credit risk linked to a certain entity by employing a systematic methodology to evaluate. The credit ratings are an assessment of the creditworthiness of various financial entities such as companies, debt instruments, financial institutions. An in-depth analysis enables ICRA to allocate transparent and reliable ratings that are influenced by various factors such as financial performance. Industry outlook, management quality. The importance of credit ratings cannot be underestimated as they help mitigate risks and provide navigation through market uncertainties. With an aim to enhance market efficiency and investor confidence, ICRA fosters transparency and credibility with its reliable credit ratings. Its rigorous credit assessments help businesses to make informed decisions and navigate the complexities in the financial dynamics with utmost confidence. ICRA credit ratings help you maximize your global credit potential with the right insights. Leverage the benefits with ICRA Rating – The historical and well as future performance prospects of the business is assessed by the rating analysis after reviewing both quantitative and quantitative factors. There are certain benefits offered that assists in enhancing the competitiveness and unlocking new opportunities with ICRA strategic advantages. Increase your access to new markets – ICRA credit ratings serve as a signal of approval to investors it can help you acquire better access to new markets and expand business globally by showcasing high credit ratings. A strong rating can help unbolt growth opportunities and instill market confidence. In ever evolving financial dynamics leveraging credit rating services can help unlock doors to untapped markets. Get to be in the eyes of potential investors by proving your organization is stable and reliable with a good credit rating. Explain your creditworthiness to external parties – Articulate your financial health and risk profile to potential parties with assessment of your organization’s creditworthiness and foster smooth negotiations by strengthening position in business transactions. Build trust and strengthen confidence within stakeholders by presenting transparent and accurate creditworthiness of your organization. Benchmark your organization’s strengths & weaknesses – it is crucial for businesses to understand where they hold a position in the financial landscape and identify areas of weaknesses and strengths. Credit ratings help provide invaluable insights regarding your organization and allows you to benchmark against industry competitors in terms of your performance. It enables you to make data- driven decisions and identify areas of improvement, implement strategic strategies and get ahead on competitive advantages. Enhance your corporate transparency – By demonstrating transparent credit rating, organizations can offer a clear view of their financial performance and allow investors to get a comprehensive view of their company finances. A thorough assessment of financial statements, profitability, liquidity and overall risk is provided. This transparent financial information is important for investors, partners since they rely on this information to make informed decisions regarding their investments. Anticipate the cost of capital – Anticipation of cost of capital by the organization serves as a fundamental aspect of financial strategy. With high credit ratings organizations get to secure lower interest rates while signaling a lower default risk. This enables organizations to secure debt at a pleasing interest rate. Similarly lower rating results in higher interest rates. By understanding the impact of their credit ratings on financial costing it enables to draw risk management strategies enabling the organization to protect against ever evolving financial changes. Choose ICRA for your credit rating needs – Embrace the power of credit ratings by integrating it into your financial strategy. Strengthen your financial foundation and position your dynamic growth with its global market presence. In the intricate financial landscape achieve a competitive advantage and gain investors confidence by showing your company’s creditworthiness. Leverage the benefits of ICRA credit rating service to achieve success and growth in the global financial market. Let ICRA help you secure reliable insights into your financial performance and provide reliable credit ratings to help you navigate complex financial dynamics with utmost confidence. For more info Visit here : www.icrallc.com

Comprehending ICRA Scorecard and its significance

Comprehending ICRA Scorecard and its significance ICRA stands out as a prominent player when it comes to offering invaluable insights via its scorecard. The very use of this tool is primarily to assess credit risk and guide investments, along with evaluating the worthiness of companies, banks, or financial instruments. The prime benefit of the ICRA Scorecard is its ability to distill complex financial information into an understandable and straightforward format. With the ICRA scorecard, the standardized framework for evaluating and assigning credit ratings is delivered accordingly, based on factors such as financial performance, industry dynamics, and macroeconomic trends. The securing of loans or credit becomes easy with the demonstration of creditworthiness. The use of scorecards simplifies the process, thereby reducing time and efforts, contributing to the management of human resources. With authentic credit ratings from well-designed scorecards, one can increase their confidence in the market, and through this, it increases a chance for the investors to engage with entities that have transparent credit assessments. A special benefit of the scorecard for the corporate customers comes with the major focus on strengths and weaknesses. This insight is further used for improvement in financial growth and other operational aspects. Navigation through the dynamic world of credit becomes unchallenging and confident for clients with their conscious decisions. The ICRA scorecard is your ultimate ally in supercharging your credit evaluations, whether you are a financial institution in UAE, Tanzania or Uganda. Used across borders, it assists in ensuring that financial institutions benefit from its thorough and reliable credit assessments. DECODING BENEFITS OF ICRA SCORECARD- Enhancing transparency – comprehensive criteria and scoring methodologies fabricate transparency in the credit evaluation process, enabling the clients to infer the understanding of the ratings. Efficiency – the use of scorecards oversimplifies the evaluation process, therefore saving precious time and valuable resources. The ICRA scorecard also helps in creating a well-informed marketplace in order to facilitate better decision-making amongst all the participants. Precautionary measures – the ultimate support in recognizing potential risks that come with lending or investing, further putting a halt to financial losses and enhancing portfolio stability with its dynamic risk management approach. Detailed analysis – with its thorough analysis, it ensures that every aspect of the financial statement is carefully analyzed and examined, thus providing an in-depth understanding of its creditworthiness. It makes sure that the clients receive a comprehensive assessment, further empowering them to take well-defined decisions. CONCLUSION – ICRA scorecard offers numerous advantages and benefits and also provides a path to navigate in the financial market with greater precision and assurance. It further provides an opportunity to propel your business forward, helping in speeding up its growth and success. It is not only a tool but an essential choice to optimize future growth and stability. Let ICRA be your partner in navigating the complexities of credit risk and upgrading the path to unlock the potential for exceptional growth and stability. Embrace the power of ICRA’s scorecard and lay the foundation for a brighter financial future. For more info Visit here : portal.icrallc.com

Understanding The Crucial Role Of Credit Rating In Business

understanding crucial role of credit ratings In Business In the world of finance, credit ratings are highly significant tools because they allow investors and creditors to have an idea of how creditworthy an entity like a government, corporation or security such as bonds is. In fact, default on debt obligations by the rated entity is the main object of credit rating. Therefore, this assessment enables investors to take risk-based lending decisions. This is where credit rating agencies come in. These are independent bodies that are set up to evaluate and provide credit ratings. ICRA is one of the prominent credit rating agencies globally. Exploring the Relevance of Credit Ratings The importance of credit ratings reverberates across the global financial landscape, manifesting in the following key aspects: Financial Health Assessment: In order to evaluate the financial health and stability of any organization, people rely on credit ratings. They assess issues such as debt levels, cash flow, profitability and management quality to ascertain likelihood of repaying debts in time. Investor Confidence: Investors will use credit ratings when deciding where to allocate capital. A higher credit rating normally means lower risk resulting in lower interest rates hence more attractive investments. On the other hand, lower ratings mean higher risk and this might lead to increased borrowing costs or even reluctance from investors. Accessibility to markets: Credit ratings have significant consequences for corporations and governments’ ability to access the capital markets. Entities with high credit ratings can borrow money on favorable terms while low ratings may restrict financing options or increase borrowing costs. Regulatory Requirements: There are regulatory guidelines covering the quality of loans held by most financial institutions. These laws are usually benchmarked with the help of credit rating agencies. For example, commercial banks may be compelled to put up more money against loans that lack a high level of trustworthiness. Risk Management: Furthermore, financial institutions and investors use credit ratings as an essential part of risk management. Traders can substantially diminish the likelihood of default by diversifying their investments portfolios based on credit ratings. Credit Rating Agencies: Nevertheless, the credibility and independence of the credit rating agencies that grant them are what makes credit ratings relevant. For instance, ICRA LLC among others conduct a comprehensive analysis of credit risks to give non-partisan estimates. Creditworthiness is essential for firms and governments who wish to tap into the international capital markets. Entities having excellent credit records could enjoy low borrowing costs while poor ratings can limit financing options or increase borrowing rates. Factors Influencing Credit Ratings – Alphabetic Scale (e.g., AAA to D) There are diverse influences on credit ratings. Financial Performance: Key indicators such as cash flow, earnings, and sales increase serve as the backbone of determining ratings thereby providing a view of how financially viable an entity is. Debt-To-Equity Ratio: A measure of debt to equity, this ratio is a good gauge for financial well-being. High ratios may increase likelihood of default while low ones indicate relatively lower risks. Market Conditions: Such elements as interest rates, inflation rate and economic growth rate can also affect credit ratings indicating market dynamics in general. Industry Trends: This would involve certain trends that, if they happen to affect revenue generations and profitability of an organization, might cut down on the credit scores with respect to customer demands or the performance of an industry. Essentially, it suggests that without good credit history these kinds of ratings are significant in terms of future financial activities as well as stability. If these individuals can understand why these credit ratings are made and how they operate, then they will be able to make informed decisions about banking thereby enhancing their economy. Topmost Credit Rating Agency ICRA ICRA is the preferred rating agency among investors, issuers and financial institutions for a number of reasons. ICRA’s strength lies in its in-depth industry expertise and understanding that spans across multiple sectors of the economy. Starting from banking and related industries to manufacturing, infrastructure, healthcare and power sectors, ICRA has thorough knowledge of all which enables it to perform accurate credit evaluations that are meaningful with respect to each sector. Moreover, ICRA’s ratings are highly esteemed for their accuracy, transparency, and adherence to stringent analytical norms. Take the first step towards a better future with ICRA. Contact Our Experts!

Credit Recommendations: Expert Advice on Managing Debt and Improving Your Financial Profile

Credit Recommendations: Expert Advice on Managing Debt and Improving Your Financial Profile Have you ever wondered how lenders decide whether to approve your loan application and at what interest rate? In today’s ever-evolving financial landscape, navigating debt responsibly is essential for securing loans, mortgages, and accessing essential financial products. Understanding your creditworthiness and taking proactive steps to improve your credit profile are critical for your financial well-being. This is where credit recommendation agency, like ICRA, can be valuable partners on your financial journey, offering expert advice and tailored recommendations to help you achieve your financial goals. How can credit recommendations help you? Credit recommendations offer several benefits to individuals seeking to manage their debt and improve their financial health: Gaining Insights into Your Creditworthiness: A credit recommendation provides a clear picture of your current credit standing. This helps you identify areas for improvement and develop a personalized strategy to enhance your credit score. Understanding Lender Perspectives: By understanding how lenders view your credit profile through a credit recommendation, you can anticipate their decisions and strategize for securing favorable loan terms. Facilitating Informed Financial Decisions: Credit recommendations empower you to make informed borrowing choices. Understanding your creditworthiness allows you to determine the type of loan you qualify for and helps you avoid excessive debt burdens. Negotiating Better Loan Terms: A strong credit recommendation can empower you to negotiate lower interest rates and better loan terms with lenders, potentially saving you money over the long term. Improving Your Overall Financial Health: By proactively managing your credit and improving your credit score, you can unlock access to better financial products and opportunities, positively impacting your future financial well-being. Expert Advice on Managing Debt and Improving Your Credit Score: Here are some key strategies recommended by financial experts to improve your credit score and manage debt effectively: Maintain Consistent On-Time Payments: This is the single most critical factor influencing your credit score. Make all credit card bills, loan installments, and other financial obligations on time and in full each month. Optimize Your Credit Utilization Ratio: Aim to keep your credit card balances below 30% of your total credit limit. Reducing your credit utilization signifies responsible credit management to lenders. Monitor your credit report regularly. Request your free credit report from each major credit bureau annually to identify any errors or inconsistencies. Dispute any inaccuracies promptly to maintain a clean credit history. Develop a Debt Repayment Plan: If you have existing debt, create a realistic repayment plan to prioritize paying it down. Focus on high-interest debts first to minimize overall interest costs. Diversify Your Credit Mix: Having a healthy mix of credit products, such as credit cards and installment loans (e.g., mortgages), can positively impact your credit score. However, avoid applying for unnecessary credit. Seek Guidance from a Credit Recommendation Agency: Agencies like ICRA can provide valuable insights and personalized recommendations to improve your credit profile and navigate financial decisions effectively. What are credit recommendation agencies? Credit recommendation agencies, like ICRA credit rating, provide objective assessments of a borrower’s creditworthiness based on their financial history and current financial standing. They analyze various factors, including credit utilization ratio, payment history, and length of credit history, to issue a credit recommendation, which can be used by lenders to make informed decisions about loan approvals and interest rates. Conclusion By following these expert recommendations and leveraging the expertise of credit recommendation agencies like ICRA credit rating, you can take control of your financial destiny. A strong credit profile unlocks access to better financial products, empowers you to negotiate favorable loan terms, and paves the way for a more secure and prosperous financial future. Remember, responsible credit management and a commitment to good financial habits are key to achieving your financial goals. Take the first step towards a better future with ICRA. Contact Our Experts!