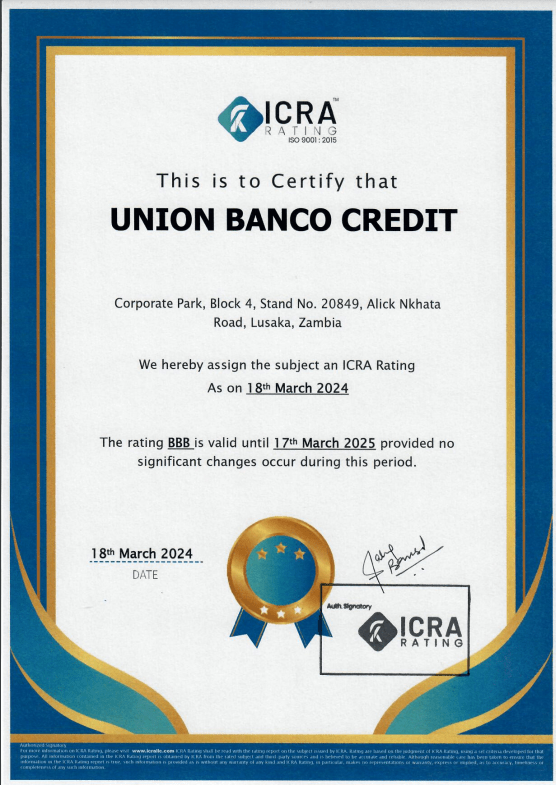

ICRA RATING assign Union Banco Credit Limited national scale long-term issuer rating to ‘BBB’ ICRA RATING assigns Union Banco Credit Limited national scale long-term issuer rating to BBB; Outlook Stable ICRA Ratings (ICRA) has assigned Union Banco Credit Limited national scale long-term issuer rating to BBB and affirmed the long-term stability of the institution in the domestic market. A rating means the entity has a considerable risk level to fulfill its financial commitments. There is a considerable risk of being adversely affected by foreseeable events and moderate credit risk on the institution

Category: Credit Rating

ICRA RATING assign Banco Micro Capital Finance Limited national scale long-term issuer rating

ICRA RATING assign Banco Micro Capital Finance Limited national scale long-term issuer rating to ‘A’ ICRA RATING assign Banco Micro Capital Finance Limited national scale long-term issuer rating to A; Outlook Stable ICRA Ratings (ICRA) has assigned Banco Micro Capital Finance Limited a national scale long-term issuer rating of A and affirmed the long-term stability of the institution in the domestic market. A rating means the entity is in a stable and strong position to fulfil its financial commitments. There is a marginal risk of being adversely affected by foreseeable events and low credit risk on the institution.

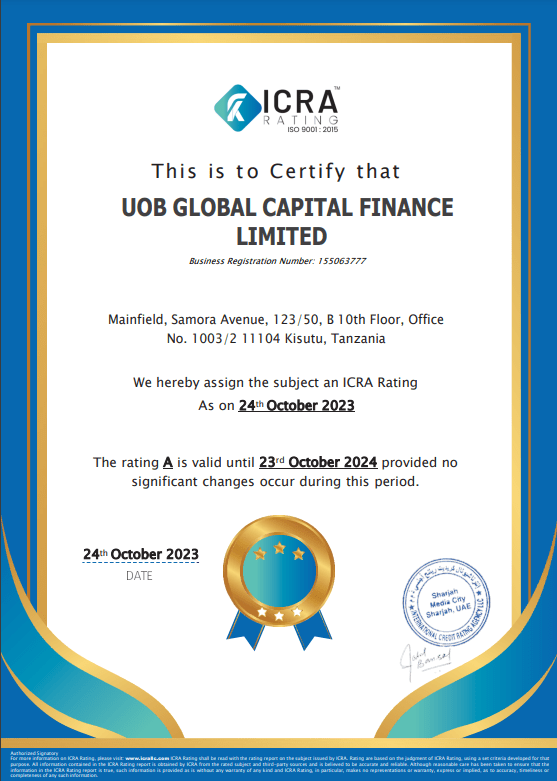

ICRA RATING assigns UOB Global Capital Finance Limited national scale long-term issuer rating to A

ICRA RATING assigns UOB Global Capital Finance Limited national scale long-term issuer rating to ‘A’ ICRA RATING assigns UOB Global Capital Finance Limited national scale long-term issuer rating to A; Outlook Stable ICRA Ratings (ICRA) has assigned UOB Global Capital Finance Limited a national scale long-term issuer rating of A and affirmed the long-term stability of the institution in the domestic market. A rating means the entity is in a stable and strong position to fulfill its financial commitments. There is a marginal risk of being adversely affected by foreseeable events and low credit risk on the institution.

ICRA Credit Ratings – Empowering Issuers with Financial Clarity

ICRA Credit Ratings – Empowering Issuers with Financial Clarity Credit ratings play a fundamental role in the functioning of capital markets along with shaping decisions regarding investments. The multifaceted role of credit ratings ranges from influencing borrowing costs to elevating economic growth and stability. This essential tool helps navigate investors, issuers, and financial institutions through the intricate dynamics of risk and opportunities in the financial sphere. At its core, credit ratings provide an evaluation of an entity’s ability to repay its financial commitment. These ratings are an indication of the likelihood of default further serving as a measure of credit risk. By providing transparent and accurate assessments, these ratings help investors make informed decisions regarding their investments. Complex financial data is translated into simplified ratings that allow the investors and financial institutions to make a comparison of the risk associated with different entities. ICRA Credit Rating Agency is one such agency that serves as a benchmark in providing reliable and accurate ratings. ICRA believes in fostering transparency with its credible insights to help maximize potential and influence investment decisions. Role Of Credit Ratings – The role of the credit ratings cannot be overstated especially when it is of profound significance for issuers. These ratings help corporations, financial institutions to influence their financial strategies, market position, investor confidence and regulatory compliance. Boosting Investor Confidence And Enhancing Market Credibility – Since these ratings are an evaluation of an issuer’s creditworthiness, the indication of these ratings help determine the overall financial health which helps investors in making well-defined decisions. A higher rating opens doors for multiple investment opportunities since a good rating is considered favorable by the investors as they rely heavily on it. The risk associated with investments is comforted by the issuer that is rated high as they are perceived as reliable and stable in financial terms. A favorable rating provides a justification for its ability to meet financial obligations by proving its credibility. Determination Of Cost Of Capital – The overall cost of debt is reduced if the issuer has a higher credit rating. Since the cost of capital is largely determined by the issuer’s credit ratings, a favorable rating has a higher chance of accessing the capital at a reasonable interest rate. Similarly, a lower credit rating can have a significant impact on their borrowing cost. These entities have a higher credit risk associated with them which makes it difficult for them to access the capital market and attract investment opportunities. Investors may generally limit their exposure to lower-rated entities and ultimately they have to face higher- interest rates. Market Perception And Investor Relations – A positive signal is indicated to the market when an entity has a higher credit rating. This helps in maintaining good relations with the investors and a good hold on the market perception of the entity. With a positive reputation, the chance for fostering trust and building confidence is elevated amongst the investors.by reinforcing a strong performance and market position, positive market perception is created for issuers with higher ratings. Meanwhile, a lower credit rating can downgrade its image in the market with a negative perception further leading to a decrease in potential investors and opportunities. Guiding Precision And Trust With ICRA – Credit ratings provided by ICRA play a crucial role in the financial sphere by providing accurate, in-depth, transparent ratings to help shape the financial strategies and decision making. ICRA serves as a barometer of creditworthiness by offering a comprehensive assessment of an entity’s credit risk further guiding investors, lenders, corporations to help influence their financial decisions. The use of methodology and in-depth analysis by ICRA are done to evaluate factors such as performance, operational efficiency, market condition, regulatory compliance. For more info Visit here : www.icrallc.com

ICRA Your Trusted Partner for Financial Clarity

ICRA Your Trusted Partner for Financial Clarity ICRA Credit Rating Agency is established with a commitment to provide in-depth insights offering clarity and reliability that are of paramount importance in the intricate world of finance. Uncertainty and risks lurk in every corner of the financial landscape and this is where reliable insightful information plays a vital role in shaping decisions. ICRA stands as a beacon of confidence and clarity when it comes to providing trusted and credible ratings helping shape investor confidence, foster economic growth, and facilitate strategic decisions. ICRA assesses the creditworthiness of various entities with its robust methodology and offers comprehensive insights on financial health and risk profiles to help drive better decision-making. With ICRA’s transparent ratings, it helps investors navigate the complex world of finance with utmost confidence. Comprehensive Services Tailored for Your Needs Like – Issuer Credit Rating – is an assessment of entities creditworthiness that provides a clear picture of their financial stability and risk associated with it. With ICRA’s analytical expertise and rigorous insights, it helps ensure that these insights are not just mere numbers but in-depth evaluations. Several factors are taken into consideration when evaluating such as the financial performance of the issuer, debt repayment history, and market position of the entity. Through these factors, a thorough assessment is done to recognize an issuer’s ability to meet financial obligations. These ratings are crucial as they play a vital role in shaping the perception of a certain entity in the market, further affecting the borrowing costs for issuers and attracting potential opportunities. Portfolio Rating – these ratings help provide an overall picture of the risk involved as it evaluates by focusing mainly on the actual portfolio of the financial institutions. With the information provided through thorough assessment it acts a helping hand in optimizing portfolio strategies and navigating the complexities in the financial market through utmost ease. Various risks associated with the financial institutions are identified such as credit risk, liquidity risk, market risk, and operational risk. This in-depth analysis ensures that institutions enhance their portfolio effectively by managing potential risks. Investors services – central to ICRA’s investors services, it offers credit ratings to help provide investors with reliable insights into the creditworthiness and risk profile of issuers as these ratings are crucial for evaluating assessment opportunities, risk associated which helps investors understand the dynamics of market and sector-specific risks and opportunities. ESG Ratings – Signifying its focus on three main criteria i.e. Environmental, Social, and Governance. These ratings drive investors towards sustainability and help them mitigate risks by fostering responsible investments through sustainable ethical practices. This shift from the traditional way of assessing to growing awareness of interconnectedness between corporate behavior and its impact on social and environment helps determine long term financial performance of a company. The impact of ESG ratings towards a positive change cannot be overstated in the evolving landscape of finance. ICRA – Premier Choice for Financial Excellence – Choosing ICRA means choosing a partner with trust, transparency and reliability in financial services. ICRA stands out as a top agency when it comes to providing in-depth, credible and accurate insights to help navigate complexities with clarity and confidence in the intricate world of finance by making well-informed decisions. With our cutting edge expertise and rigorous methodologies we ensure that your decisions are strategic, informed and forward looking in order to help you elevate your financial growth and journey with utmost clarity. For more info Visit here : www.icrallc.com

A comprehensive overview of ICRA Credit Rating services

A comprehensive overview of ICRA Credit Rating services ICRA credit ratings play a crucial role in helping the clients navigate through intricate dynamics of the financial world. It assists the clients in assessing the risk associated with investment opportunities in the financial market and helps them make well-defined decisions. These ratings are an indication of the issuer’s ability to meet financial obligations in a provided time frame. ICRA communicates the credit risk linked to a certain entity by employing a systematic methodology to evaluate. The credit ratings are an assessment of the creditworthiness of various financial entities such as companies, debt instruments, financial institutions. An in-depth analysis enables ICRA to allocate transparent and reliable ratings that are influenced by various factors such as financial performance. Industry outlook, management quality. The importance of credit ratings cannot be underestimated as they help mitigate risks and provide navigation through market uncertainties. With an aim to enhance market efficiency and investor confidence, ICRA fosters transparency and credibility with its reliable credit ratings. Its rigorous credit assessments help businesses to make informed decisions and navigate the complexities in the financial dynamics with utmost confidence. ICRA credit ratings help you maximize your global credit potential with the right insights. Leverage the benefits with ICRA Rating – The historical and well as future performance prospects of the business is assessed by the rating analysis after reviewing both quantitative and quantitative factors. There are certain benefits offered that assists in enhancing the competitiveness and unlocking new opportunities with ICRA strategic advantages. Increase your access to new markets – ICRA credit ratings serve as a signal of approval to investors it can help you acquire better access to new markets and expand business globally by showcasing high credit ratings. A strong rating can help unbolt growth opportunities and instill market confidence. In ever evolving financial dynamics leveraging credit rating services can help unlock doors to untapped markets. Get to be in the eyes of potential investors by proving your organization is stable and reliable with a good credit rating. Explain your creditworthiness to external parties – Articulate your financial health and risk profile to potential parties with assessment of your organization’s creditworthiness and foster smooth negotiations by strengthening position in business transactions. Build trust and strengthen confidence within stakeholders by presenting transparent and accurate creditworthiness of your organization. Benchmark your organization’s strengths & weaknesses – it is crucial for businesses to understand where they hold a position in the financial landscape and identify areas of weaknesses and strengths. Credit ratings help provide invaluable insights regarding your organization and allows you to benchmark against industry competitors in terms of your performance. It enables you to make data- driven decisions and identify areas of improvement, implement strategic strategies and get ahead on competitive advantages. Enhance your corporate transparency – By demonstrating transparent credit rating, organizations can offer a clear view of their financial performance and allow investors to get a comprehensive view of their company finances. A thorough assessment of financial statements, profitability, liquidity and overall risk is provided. This transparent financial information is important for investors, partners since they rely on this information to make informed decisions regarding their investments. Anticipate the cost of capital – Anticipation of cost of capital by the organization serves as a fundamental aspect of financial strategy. With high credit ratings organizations get to secure lower interest rates while signaling a lower default risk. This enables organizations to secure debt at a pleasing interest rate. Similarly lower rating results in higher interest rates. By understanding the impact of their credit ratings on financial costing it enables to draw risk management strategies enabling the organization to protect against ever evolving financial changes. Choose ICRA for your credit rating needs – Embrace the power of credit ratings by integrating it into your financial strategy. Strengthen your financial foundation and position your dynamic growth with its global market presence. In the intricate financial landscape achieve a competitive advantage and gain investors confidence by showing your company’s creditworthiness. Leverage the benefits of ICRA credit rating service to achieve success and growth in the global financial market. Let ICRA help you secure reliable insights into your financial performance and provide reliable credit ratings to help you navigate complex financial dynamics with utmost confidence. For more info Visit here : www.icrallc.com

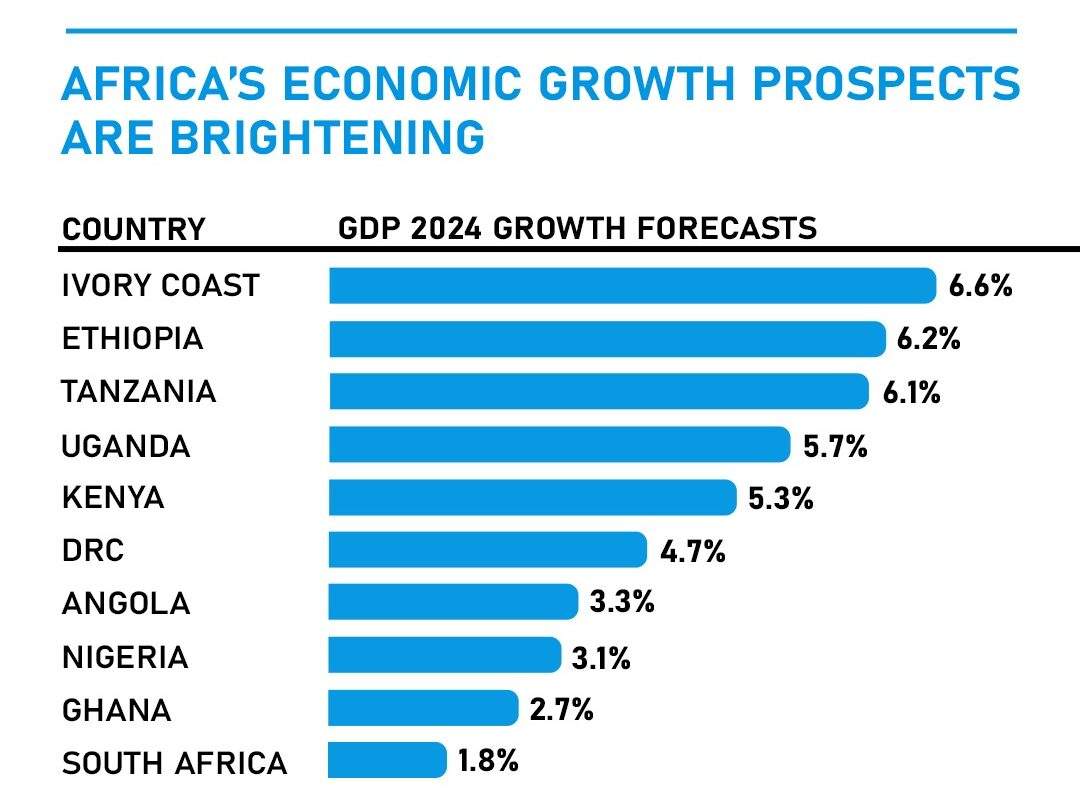

Ivory Coast Overtakes South Africa in Economic Growth Surge

Ivory Coast Overtakes South Africa in Economic Growth Surge A ray of growth and economic outshine is expected as sub-saharan africa’s growth is accelerating with two of its biggest economies leading the way. Ivory Coast, one of the largest producers of cocoa is projected to have 6.6% growth, having surpassed south africa as the highest rated sovereign in sub-saharan africa with foreign debt outstanding. Having said that, it is also anticipated that Tanzania will also beat 6%, according to the IMF. Africa’s economic growth prospects are brightening with Ethiopia now accounting for almost a 10th of GDP. Economic recovery is predicted to continue beyond this year, with growth projected to 4.0 in 2025. The region’s two year pause from international capital markets came to an end with Ivory Coast’s successful eurobond issuance in January 2024. Additionally, inflation has dropped to almost half resulting in public debts having been broadly stabilized. The yield on Ivory Coast’s debt maturing in 2028 decreased by 13 basis points to 7.09% on Monday, reaching its lowest level since April 15. Meanwhile, South Africa’s dollar debt due in 2030 saw its yeild drop to 6.9%, down from over 8.5% in October. Despite a significant reduction in cocoa production in the country, the Ivorian economy remains as one of the region’s fastest blooming with an expected rise in the commodity exports over the next two years. With major catastrophic harvests, resulting in record- high cocoa prices, the ivory government was able to secure a funding agreement of $4.8 billion with the IMF. In January, Ivory Coast broke sub- saharan Africa’s two year lockout from international capital markets by selling $2.6 billion in eurobonds. However, with a strong track record in the global financial market it is further prescribed for a fiscal consolidation inorder to stabilize the debt levels. An elevation towards a more positive number for Ivory Coast’s economy is expected mainly due to the contribution of an increased commodity exports. Get comprehensive credit ratings through one of the top company ICRA ratings, that can significantly benefit you by providing invaluable insights into the creditworthiness of various entities, further assisting in boosting confidence and help you take well-defined decisions to ensure growth and stability in your financial domain. With ICRA’s detailed analysis, gain insights into improving your overall financial planning and build a company of trust and confidence. Discover the power of credit ratings and let ICRA Credit Rating help you to navigate through complexities with greater security and trust in the financial sphere. Take the first step towards a better future with ICRA. Contact Our Experts!