Navigating Financial Success with ICRA Scorecard At ICRA, we provide a holistic view of an entity’s credit profile by taking into consideration alot of factors with the ICRA Scorecard. ICRA Scorecard is not just an evaluation tool that provides a comprehensive report by assessing credit worthiness of an entity but it also provides an understanding of credit risk associated to help investors make well-defined financial decisions. ICRA Scorecard is a free of cost tool which enables investors to leverage its benefits with evaluation of their financial performance. Various factors such as management quality, market position and industry dynamics are taken into consideration while assessing a company’s credit standard. With ICRA Scorecard boost your confidence and be in the eyes of the investors with demonstration of transparent credit assessments. So whether you are a financial institution in Uganda, Tanzania or UAE let ICRA Scorecard be your ultimate ally in supercharging your credit evaluations. Securing loans or credit has been easier only if you choose to avail your ICRA Scorecard today. Leverage ICRA Scorecard benefits – ICRA Scorecard has a huge influence on the financial market since investors and lenders rely on accurate and reliable credit assessments. ICRA Scorecard offers a holistic view of the creditworthiness of the entity with a detailed insight into the entity’s financial performance and risk profile. Insights such as cash flow, debt levels, and revenue are helpful since they guide investors into making well-defined investment decisions by assessing the overall financial profile of the entity. This clear demonstration of an entity’s financial profile assists in identifying, monitoring, and measuring any potential risks. The use of robust methodology with quantitative and qualitative metrics ensures a standard level of rating and allows easy comparison between entities in the industry. With a high score one can open the door for more investment opportunities get to be in the eye of the investors and gain access to better funding at lower rates. This enables an entity to showcase its credibility and a chance to uplift its reputation in the market with a strong rating. ICRA – Your Partner for Comprehensive Credit Insights ICRA Scorecard is a zero-cost comprehensive tool with thorough evaluation designed in a way to elevate your financial decisions. Investors and lenders get a better understanding with accurate assessments further fostering confidence in them while making any investment decisions. ICRA’s extensive global reach makes ICRA Scorecard an invaluable tool for cross-border financial insights. Get a holistic view and detailed analysis of your financial profile, company performance, and industry position that will assist you in comprehending your financial stability and areas to be improved for future growth and opportunities. With a clear picture of your position in the market, this insight will help you plan your strategic moves for a better performance against the competitors within the industry. With a commitment to providing reliable and accurate insights, ICRA’s global reach with over 110 ratings delivered across 25 countries in diverse industries serves as a testament to its vision. Let ICRA be your partner in navigating complexities with precision and making well-defined decisions to achieve strategic success and growth. For more info Visit here: www.icrallc.com

Category: Featured Highlights

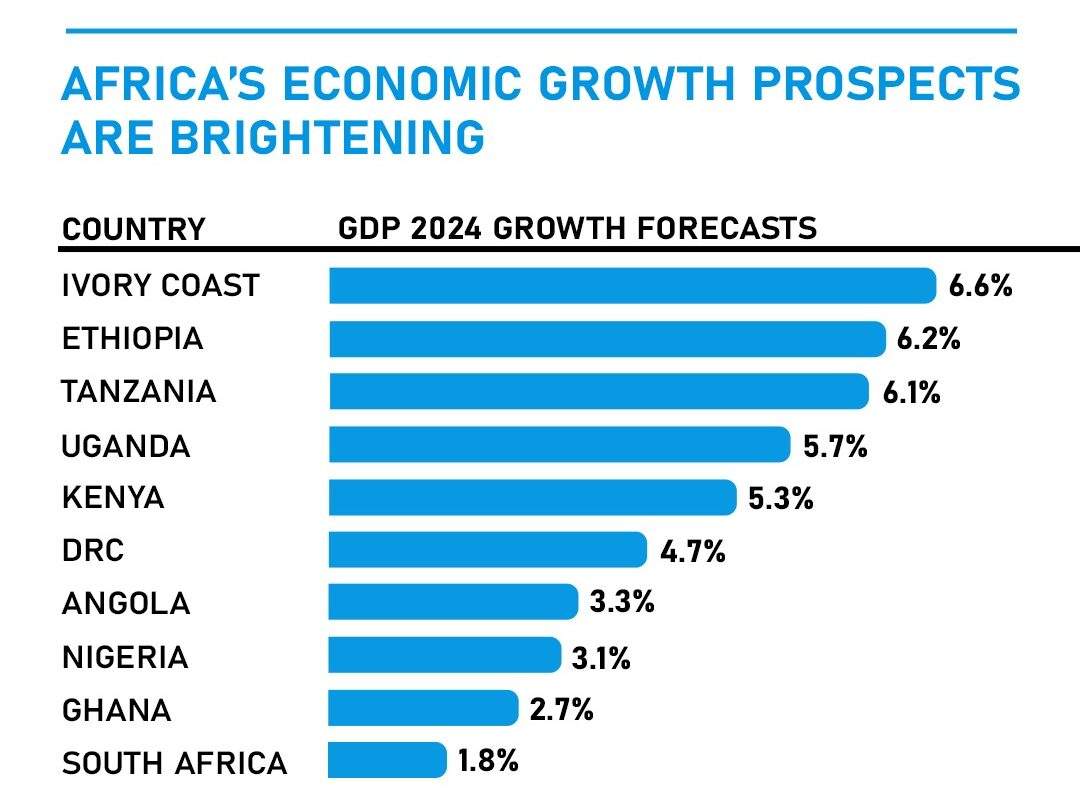

Ivory Coast Overtakes South Africa in Economic Growth Surge

Ivory Coast Overtakes South Africa in Economic Growth Surge A ray of growth and economic outshine is expected as sub-saharan africa’s growth is accelerating with two of its biggest economies leading the way. Ivory Coast, one of the largest producers of cocoa is projected to have 6.6% growth, having surpassed south africa as the highest rated sovereign in sub-saharan africa with foreign debt outstanding. Having said that, it is also anticipated that Tanzania will also beat 6%, according to the IMF. Africa’s economic growth prospects are brightening with Ethiopia now accounting for almost a 10th of GDP. Economic recovery is predicted to continue beyond this year, with growth projected to 4.0 in 2025. The region’s two year pause from international capital markets came to an end with Ivory Coast’s successful eurobond issuance in January 2024. Additionally, inflation has dropped to almost half resulting in public debts having been broadly stabilized. The yield on Ivory Coast’s debt maturing in 2028 decreased by 13 basis points to 7.09% on Monday, reaching its lowest level since April 15. Meanwhile, South Africa’s dollar debt due in 2030 saw its yeild drop to 6.9%, down from over 8.5% in October. Despite a significant reduction in cocoa production in the country, the Ivorian economy remains as one of the region’s fastest blooming with an expected rise in the commodity exports over the next two years. With major catastrophic harvests, resulting in record- high cocoa prices, the ivory government was able to secure a funding agreement of $4.8 billion with the IMF. In January, Ivory Coast broke sub- saharan Africa’s two year lockout from international capital markets by selling $2.6 billion in eurobonds. However, with a strong track record in the global financial market it is further prescribed for a fiscal consolidation inorder to stabilize the debt levels. An elevation towards a more positive number for Ivory Coast’s economy is expected mainly due to the contribution of an increased commodity exports. Get comprehensive credit ratings through one of the top company ICRA ratings, that can significantly benefit you by providing invaluable insights into the creditworthiness of various entities, further assisting in boosting confidence and help you take well-defined decisions to ensure growth and stability in your financial domain. With ICRA’s detailed analysis, gain insights into improving your overall financial planning and build a company of trust and confidence. Discover the power of credit ratings and let ICRA Credit Rating help you to navigate through complexities with greater security and trust in the financial sphere. Take the first step towards a better future with ICRA. Contact Our Experts!

Introducing the ICRA Scorecard Revolutionizing Credit Assessment

Introducing the ICRA Scorecard: Revolutionizing Credit Assessment In the dynamic and constantly evolving realm of finance, quick and accurate decision-making is absolutely essential. At ICRA Rating, we recognize this need and are thrilled to introduce the ICRA Scorecard, a revolutionary tool that simplifies the lending process for various financial institutions, including microfinance institutions (MFIs), Banks, SACCOs, Insurances, and corporations. With the ICRA Scorecard, you can make confident and informed decisions. Count on us to help you succeed in the fast-paced world of finance. In a remarkable display of commitment to the greater good, ICRA Rating offers the ICRA Scorecard free of charge. This levels the playing field for lenders by democratizing access to cutting-edge credit assessment tools. Whether you’re a financial institution in the bustling cities of the United Arab Emirates, the vibrant markets of Tanzania, or the burgeoning economy of Uganda, the ICRA Scorecard is readily available to support your lending decisions. Unveiling the ICRA Scorecard The ICRA Scorecard represents a significant leap forward in credit assessment methodology. It is an in-demand tool, meticulously crafted to expedite lending processes while ensuring precision and reliability. At its core, the scorecard aims to empower lenders with actionable insights into the creditworthiness of potential borrowers. Empowering Decision-Making In a landscape where time is of the essence, the ICRA Scorecard emerges as a beacon of efficiency. By leveraging advanced algorithms and data analytics, it empowers lenders to make informed decisions regarding loanable amounts, interest rates, and loan terms swiftly. This not only enhances operational efficiency but also minimizes the risk associated with lending. The Path to Financial Inclusion One of the key objectives of the ICRA Scorecard is to foster financial inclusion on a global scale. By providing a standardized assessment tool, ICRA Rating aims to facilitate access to credit for individuals and businesses across diverse socio-economic backgrounds. This helps to promote fairness and equality in the financial sector. Join the Revolution The ICRA Scorecard represents more than just a tool; it embodies a paradigm shift in credit assessment. By embracing innovation and inclusivity, ICRA Rating paves the way for a future where access to credit knows no boundaries. Join us in shaping this future – reach out today to unlock the power of the ICRA Scorecard and revolutionize your lending operations. Visit Here – portal.icrallc.com Take the first step towards a better future with ICRA. Contact Our Experts!

5 Cs Which Help In the Credit Worthiness Of A Company

5 Cs Which Help In the Credit Worthiness Of A Company There is a normal process in B2B transactions in which the customer can purchase the goods or services from you and will pay you at a later stage. By this, you can easily encourage sales and stimulate business growth. You can invoice your clients anytime after you deliver the goods or the services. Your cash flow can be disrupted, and the lie o your business. To reduce the financial risk, it is essential to determine the customer’s creditworthiness before you extend the credit. So, for the company’s creditworthiness, it is necessary to know about the customer’s creditworthiness. The right tools help you determine the creditworthiness of the customer. It also helps in protecting your business from late payments or non-payment on invoices. What Is Creditworthiness and How Can One Analyse It? In simple words, creditworthiness is the ability of your customers to pay. So, before extending the trade credit, it is essential to understand the customer’s creditworthiness. It is necessary to understand the reputation of the customer to pay on time and their capacity to continue to do so. Understanding the customer’s creditworthiness includes their revenue and outstanding obligations. Understanding the company’s future business prospects and the trends within the industry is essential as it could affect their ability to pay. The 5 C’s OF Credit To Conduct A Credit Assessment The 5 Cs of creditworthiness help determine the risk of extending the credit and quantifying the credit limits. Following are some of the 5Cs of credit used in assessing the creditworthiness of the company: Character: Your trade partner should be trustworthy. The excellent reputation of the business helps in sustaining in the market. The character of the trade partner can be accessed through the business references. You should also review the business’s credit history and analyze the business’s reputation in the market. Capacity: The prospect can be made through which your client can pay your invoices. Or, you should clearly understand the business’s cash flow situation. The debt-to-income ratio should also be analyzed and compared to the historical revenue Collateral: Your client could liquidate certain assets to settle the debt. Part of effective credit analysis is to know what assets your client or trade partner has, such as equipment or accounts receivable. Capital: It helps in understanding the ability of the client to pay for your goods or services. The financial statement of the client should be reviewed thoroughly. Conditions: Certain conditions could affect your trade partner’s business. You can understand whether the company would continue to be viable only through the economy, the political situation in the country of operation, and the threats or opportunities of the industry. Consider ICRA for Determining The Creditworthiness OF The Company Businesses often rely on their customers. It is imperative to keep an eye on the client’s financial health. The 5 Cs discussed in this blog would help check the company’s credit score online. It would help in minimizing the risk. Take the first step towards a better future with ICRA. Contact Our Experts!

What is Commercial Credit Rating?

What is Commercial Credit Rating? To remain competitive and attract clients, financial and commercial companies must perform credit ratings. It helps to demonstrate the creditworthiness of the individual, corporation, state, or sovereign government. The future lender gets aware of the risk that exists in the future with the help of the credit score. Credit information companies or credit bureaus also assign business credit scores. Top Credit Rating Agencies You must have come across the term Credit Rating in the commercial and financial sector. So, before going further, there are a few questions that come to mind What is a commercial credit rating? What does the credit rating indicate? Which companies offer credit ratings? Is it considered essential for companies to undergo thorough credit ratings? These are some basic questions the business should be aware of to sustain itself in the market. Commercial Credit Rating Services So, we are here to help you understand the concept of Commercial Credit Rating and learn about the top credit rating agency in Dubai. We also provide some points that support the business to sustain itself in the market by improving its ratings. In Dubai, many credit rating agencies assign credit ratings. Credit rating agencies provide both qualitative and quantitative assessments. Any entity can borrow money through a credit rating. Process of Credit Rating The credit rating agency takes the details of an entity. The details are analyzed so that everyone in the market can use the ratings. The borrower is assessed based on the loan that the agency takes. The borrower has to repay their financial obligations. Following are some of the credit rating processes in Dubai by ICRA: Ratings are requested from the issuer of the debt. ICRA, the rating agency, does the initial evaluation Meeting the requirements with the management of the issuer. The various factors are analyzed in running the commercial and the financial sector. The team of ICRA reviews the analysis and votes on the ratings. The rating is notified to the issuer timely. Factors On Which Credit Rating Is Assigned Some factors are taken into effect before the credit ratings are issued because these credit ratings are both qualitative and quantitative. The credit rating depends on the macro and the microeconomic factors available. It also helps focus on the competitive position held by the commercial sector. The financial sector also plays an important role. The financial policies, capital structure, liquidity position, and cash flow also decide the credit rating. Moreover, credit ratings are evaluated through the various factors of different industries. For example, in Dubai, the commercial and financial sector uses the ICRA rating to stand in the market. Credit Rating Available To All For Access Credit ratings are readily available, so investors can easily access the ratings given to any corporates. It can only be accessed by the individual or the lender when the individual applies for the credits. By assessing the credits provided by the commercial credit rating agency ICRA, corporations and the financial sector can easily sustain themselves in the market. Moreover, credit ratings are evaluated through the various factors of different industries. For example, in Dubai, the commercial and financial sector uses the ICRA rating to stand in the market. Take the first step towards a better future with ICRA. Contact Our Experts!

How High-Quality Commercial Credit Rating Is Beneficial?

How High-Quality Commercial Credit Rating Is Beneficial? ICRA LLC is a credit rating agency based in UAE, with an experience of around 25 years in Audit, Certification, and Inspection. The agency is top-notch in providing commercial and financial rating, which has a lot of benefits for the borrowers and the lenders as well. In simpler terms the commercial credit ratings is a numerical assessment of the firm’s creditworthiness. The ratings by ICRA are fully independent, and after analysing all the aspects of the commercial firm the ratings are assigned. Furthermore these ratings have a big influence on the market value of the firm. Jump into the pool of information Let us know everything about the credit rating process and its benefits What Is Credit Rating? Credit rating is assessment of the creditworthiness of a borrower in general terms or with respect to a financial obligation. A Credit Rating is assigned to any entity that wants to borrow money. It can be an individual, a corporation, a state or a sovereign government. ICRA’s Credit Rating Process is hassle-free, and till now the firm has rated so many commercial institutions. ICRA follow a simple credit rating process: Issuing Formal Request Assigning to Credit Risk Team Obtaining Financial Information Research and financial statement analysis Discussion meeting Rating Committee meeting Communication of decision Merits of Commerial Credit Ratings Easy Loan Approval: One of the major benefits that a firm with high credit ratings can enjoy is the easy approval of loans. Higher the rating, more the company is seen as a risk-free firm, which is why lenders are more comfortable while making decisions. Safety Assured: For the lenders the credit ratings of the issuer firm plays a significant role as well. The high ratings shows the assurance about the safety of the money that it will be paid back with interest on time. Discounted Rate Of Interest: Good credit rating helps borrowing companies to get debt at less rate of interest because one of the major factors that determine the rate of Interest on debt is the credit rating. Higher the rating, lower the Interest or vice versa. Better Decision Making: No bank or money lender Companies would like to give money to a risky company. With Credit Rating, they can get a better idea about the repayment capacity of that company so credit rating services helps banks and money lenders to make better Investment decisions. In simpler terms the commercial credit ratings is a numerical assessment of the firm’s creditworthiness. The ratings by ICRA are fully independent, and after analysing all the aspects of the commercial firm the ratings are assigned. Furthermore these ratings have a big influence on the market value of the firm. Jump into the pool of information Let us know everything about the credit rating process and its benefits Take the first step towards a better future with ICRA. Contact Our Experts!